- What is BoostMyMoney?

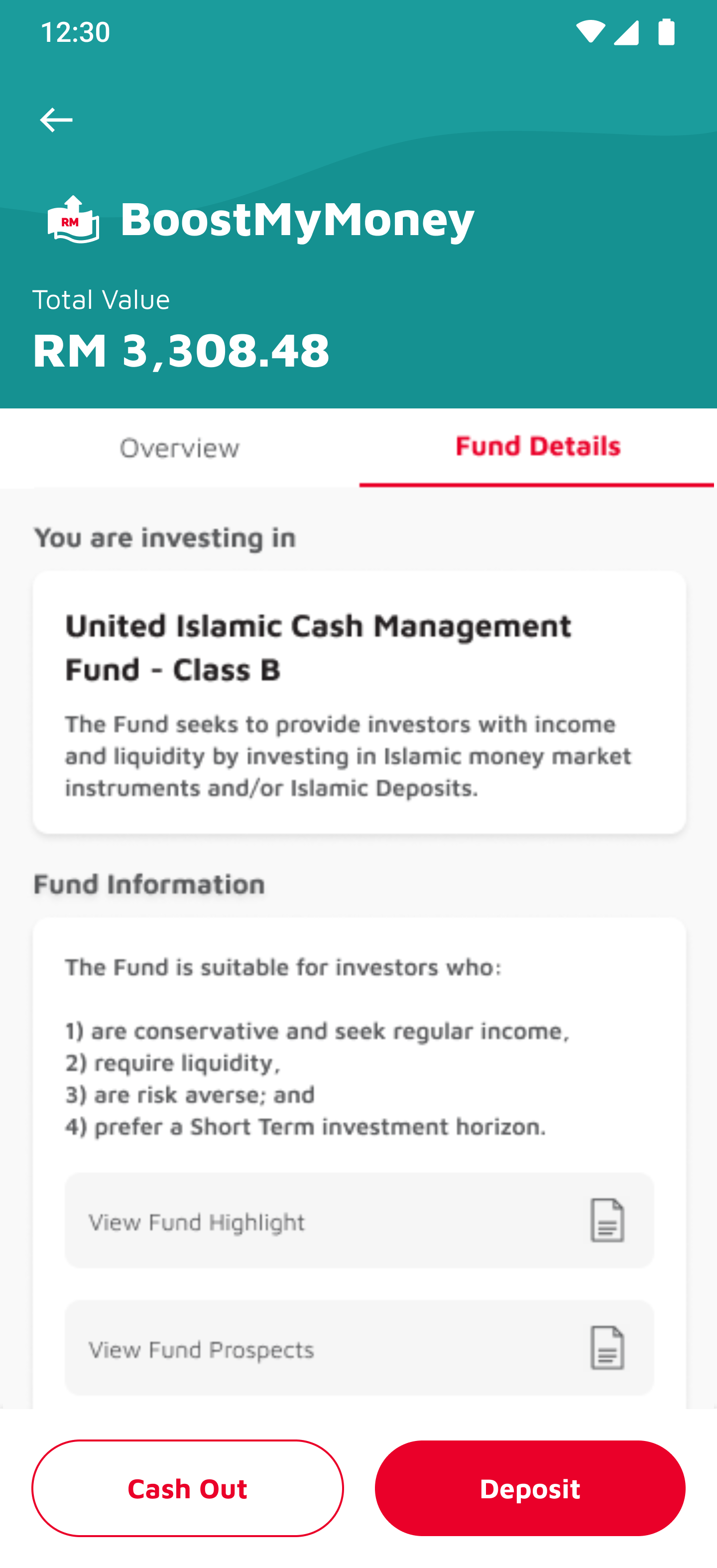

BoostMyMoney is an investment platform offered on the Boost app in partnership with UOB Asset Management (Malaysia) Berhad (“UOBAMM”) and is designed to allow users to earn potential returns on their BoostMyMoney balance. The underlying fund for BoostMyMoney investment platform is the United Islamic Cash Management Fund (“Fund”) – a Shariah-compliant Money market Fund managed by UOBAMM that aims to provide investors with liquidity and income. The Fund is owned by UOBAMM and Boost serves only as a platform provider to enable customers to invest in the UOBAMM Fund. - How can I make an investment through the Boost app?

You can now invest in the United Islamic Cash Management Fund, an Islamic Money Market Fund (“Fund”) managed by UOB Asset Management (Malaysia) (UOBAMM) through BoostMyMoney, a new investment platform available on the Boost app ("Investment Platform"). Refer to the Boost Product Disclosure Sheet and UOBAMM Product Highlights Sheet to understand more on the investment fund made available via BoostMyMoney. - What is so unique about BoostMyMoney?

BoostMyMoney is the first investment product by Boost that allows you to start investing with your Boost Wallet monies from as low as RM1 and gain potential returns. It comes with an exciting loyalty rewards program, rewarding you with Boost Stars as you save. The longer you save, the more Boost Stars you earn as you move up the BoostMyMoney rewards tier. - What are the benefits of investing in BoostMyMoney?

- Convenient way to start investing from as low as RM1

- Shariah-compliant

- Potential investment returns

- Safe and secure platform

- No lock-in period, giving you the flexibility to access your money at anytime

- Additional perks and loyalty rewards

- What is Shariah-compliant investments? Is BoostMyMoney Shariah-compliant?

Shariah-compliant investments are investments based on the principles of Islamic finance. The underlying fund for BoostMyMoney is the United Islamic Cash Management Fund (“Fund”) – a Shariah-compliant Money market Fund managed by UOBAMM. - Where can I get the Fund details?

You can refer to the Boost Product Disclosure Sheet and UOBAMM Product Highlights Sheet to understand more about the investment fund made available with BoostMyMoney. Alternatively, if you have signed up with BoostMyMoney, you can review the Fund details by accessing the BoostMyMoney dashboard and clicking the arrow next to “Total Value”. - Where can I view the prospectus, product highlight sheet and/or fund’s documents?

You can find the prospectus for UOBAMM funds in the UOBAMM website. For information on BoostMyMoney and its related funds, you can refer to Boost Product Disclosure Sheet and UOBAMM Product Highlights Sheet. - Are the funds protected by Perbadanan Insurans Deposit Malaysia (PIDM)?

No, the funds are not protected by PIDM, but any investment or capital/money market fund is regulated by the Securities Commission Malaysia (SC). - Are the platform and funds regulated by Securities Commission Malaysia (SC)?

Yes, both the BoostMyMoney platform and UOBAMM funds are governed and regulated by the SC. - Are the platforms and funds approved by Bank Negara Malaysia (BNM)?

Boost as a E-Money issuer licensed by BNM, has obtained approval to cross-sell UOBAMM investment product to Boost users. UOBAMM funds are governed and regulated by the Securities Commission Malaysia (SC). Boost does not own any investment or capital/money market fund. - Who is eligible to invest through BoostMyMoney?

BoostMyMoney welcomes participation from eligible individuals in Malaysia. To be qualified, you must fulfil the following criteria:- Boost Premium User: You need to be a registered Boost Premium user. If you're not a Boost Premium user, you can upgrade for FREE to a Premium wallet by simply going to ‘Profile’ page on Boost app and clicking on ‘Upgrade to Premium Wallet’.

- Age Requirement: You must be at least 18 years old.

- Account Verification: You must have completed the BoostMyMoney onboarding process.

- If I am a foreigner, can I invest in BoostMyMoney?

No, unfortunately we do not allow non-Malaysians to invest in BoostMyMoney. - If I am a foreigner, but Malaysian taxpayer, can I invest in BoostMyMoney?

No, unfortunately we do not allow non-Malaysians to invest in BoostMyMoney. - What should I take into consideration before investing in BoostMyMoney?

You are advised to read and understand the Boost Product Disclosure Sheet and UOBAMM Product Highlights Sheet before investing. Please be advised that any investment-related Funds carry risks. An outline of the various risks involved is described in the UOBAMM Product Highlights Sheet. As an investor, you should make your own risk assessment and seek professional advice where necessary. - Can I open a Joint Account?

No, only one (1) Boost and UOBAMM investment account will be available for each user.

- How do I get started?

Open the Boost app and locate the BoostMyMoney icon under ‘More’ page on the Boost app homepage.

For Boost Basic Wallet Users:

You are required to upgrade your Basic account to Premium wallet for FREE (and unlock additional benefits) before using BoostMyMoney.- Click on the BoostMyMoney icon under ‘More’ page on Boost app homepage.

- Complete your Profile by verifying your identity (ID) with EKYC

- When you receive a notification that your ID is verified, proceed to provide us with your additional details.

- Once your Profile is Complete, you are an approved Premium wallet user!

- Create your BoostMyMoney Account by answering a few more questions and submit.

- You will be notified that your BoostMyMoney account is created, and you can perform your first deposit to initiate your BoostMyMoney experience.

- You can view your BoostMyMoney dashboard.

As our Boost Premium Wallet users, you have the privilege to use BoostMyMoney almost immediately.- Click on the BoostMyMoney icon under ‘More’ page on Boost app homepage.

- If your Profile is not complete, you will need to provide us with your additional details.

- Once your Profile is complete, start by clicking “Create BoostMyMoney Account,” answer a few questions, and submit.

- You will be notified that your BoostMyMoney account is created, and you can perform your first deposit to initiate your BoostMyMoney experience.

- You can view your BoostMyMoney dashboard.

- Click on the BoostMyMoney icon under ‘More’ page on Boost app homepage.

- You can view your BoostMyMoney dashboard.

- Select the "Deposit" feature and use your Boost Wallet balance to make investments via BoostMyMoney.

- Can I open more than one Investment Account?

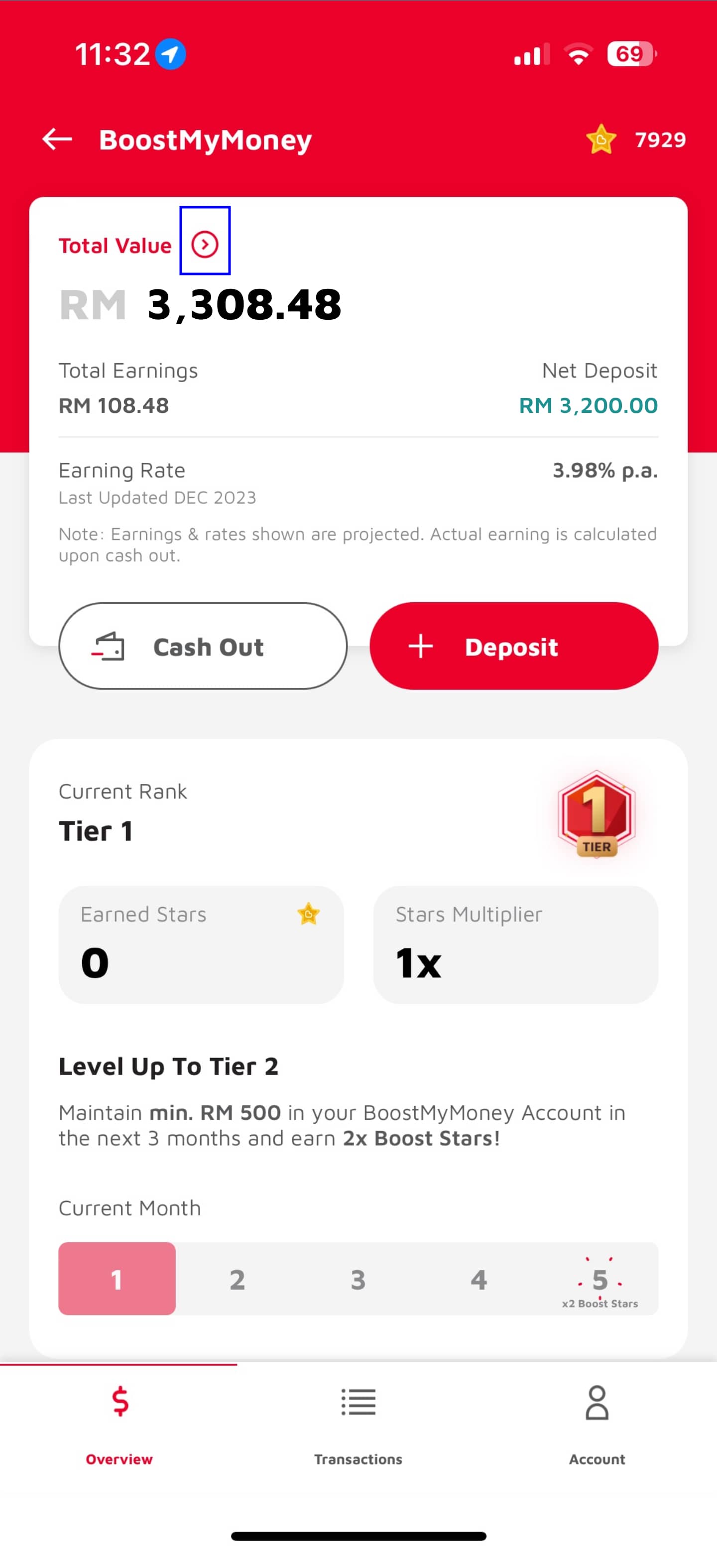

No. Each Boost user is entitled to only one BoostMyMoney account. - What is “Earning Rate”?

Earning Rate is a projected/estimated gross return rate (excluding Management and Trustee fees) per annum for your investment in the United Islamic Cash Management Fund over the next 12 months.

For example,Important Disclaimer:Earning Rate3.8% per annumFee Deduction Management Fee (-) 0.5% per annum Trustee Fees (-) 0.025% per annum Projected Net Earning Rate / Returns 3.275% per annum - Please note that the earnings/returns mentioned above are projections and are subject to potential changes in Net Asset Value (NAV).

- Any investment involves risks, and past performances are not indicative of any guaranteed future results.

- What is “Total Earnings”?

Total Earnings refer to the projected sum of returns you have generated through your investments with BoostMyMoney. The total earnings/returns mentioned within the BoostMyMoney dashboard are projections and not indicative of any guaranteed earnings. Actual earnings are re-calculated upon cash-out. - What is “Total Value”?

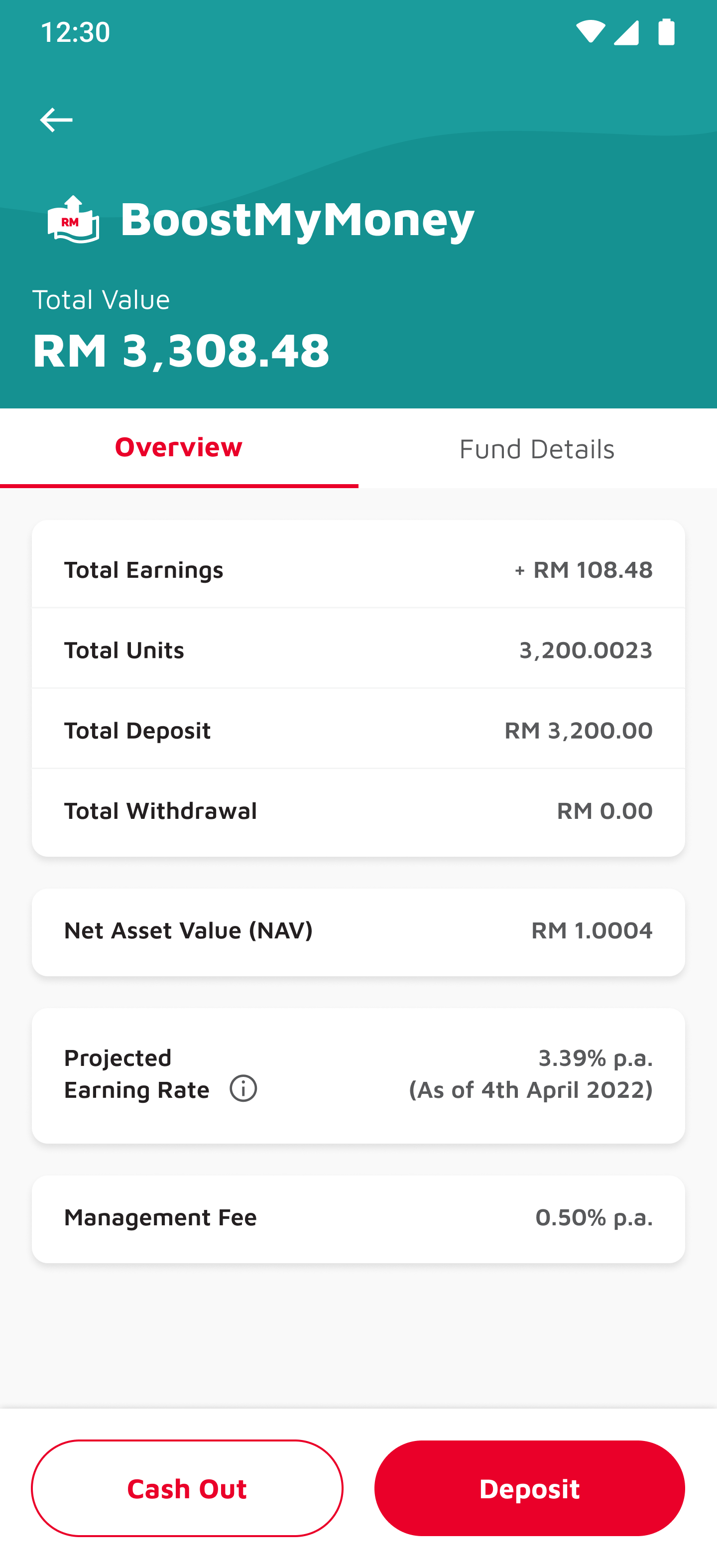

“Total Value” refers to the amount of funds in MYR that you currently have in your BoostMyMoney account. It represents the total value of your available funds that can be used for further investments or withdrawals. Your balance will consist of both the invested amount (MYR) and any earnings or profits you have accumulated over time. - How can I view my fund details?

To view your fund details on BoostMyMoney, you can follow these steps:- Open your Boost app and click on the BoostMyMoney icon under ‘More’ page.

- You can view the BoostMyMoney dashboard.

- Look for the > icon beside “Total Value”.

- You can view a summary of your investment in “Overview” and review the fund information via “Fund Details”.

- How can I view my transactional activities?

To view your transaction activities on BoostMyMoney, you can follow these steps:- Open your Boost app and click on the BoostMyMoney icon under ‘More’ page.

- You can view the BoostMyMoney dashboard.

- Click on the “Transactions” icon at bottom.

- You should be able to see a comprehensive list of your past transactions which includes deposits and withdrawal of your BoostMyMoney account.

- What is the BoostMyMoney loyalty program?

The BoostMyMoney loyalty program is a program designed to reward and provide additional benefits to loyal customers of BoostMyMoney. - How does the BoostMyMoney loyalty program work?

With BoostMyMoney, you get rewarded with Boost Stars every month for maintaining a minimum Monthly Average Balance (MAB) of RM500. The longer you save, the more stars you earn as you move up the BoostMyMoney Boost Star rewards tier. - What is Minimum Average Balance (MAB)?

The minimum average balance required by BoostMyMoney refers to the minimum amount of funds (Balance) you need to maintain, on average, in your account on a monthly basis. This requirement ensures that you meet the criteria set by BoostMyMoney to progress to another tier and unlock higher multiplier. The calculation of the minimum average balance involves adding up the daily balances of your account over a specific period and dividing it by the number of days in that period.

Here's an example to illustrate how the minimum average balance of RM500 is calculated:

Month: July

Number of days in July: 31

Let's assume your daily balances for each day in July are as follows:

Day 1: RM500

Day 2: RM1200 (Original Balance: RM500, Deposit: RM700)

Day 3: RM1500 (Original Balance: RM1200, Deposit: RM300)

Day 4: RM1500

...

Day 31: RM900 (Original Balance: RM1500, Withdrawal: RM600)

To calculate the minimum average balance, you would add up the daily balances and divide by the number of days:

Total daily balance for July: RM500 + RM1200 + RM1500 + RM1500 + ...add daily balances... + RM900 = RMX (total balance)

Minimum Average Balance for July: RMX (total balance) / 31 (number of days) = RMY

If RMY (the minimum average balance) is equal to or greater than RM500, then you would have met the requirement for that month. However, if RMY is below RM500, you would not meet the minimum average balance requirement and will not receive the loyalty rewards. - How can I receive a sign-up bonus?

To receive a sign-up bonus, you will need to meet below criteria:- Create an account with BoostMyMoney and complete the onboarding process.

- Deposit a minimum of RM500 as your first-time deposit.

- Keep it for 5 days.

- You will receive the bonus on the 6th day.

- What are the BoostMyMoney Boost Star rewards tier and how does it work?

You may earn additional rewards according to the tier you have achieved. Higher tiers will provide more rewards:

For example,TierMonthLoyalty Reward Multiplier

(RM1 = X Stars)1 1 – 4 month 1 2 5 – 8 month 2 3 9 – 12 month 3

Let's assume you join the loyalty program in January, and for the first four months (January, February, March, and April), you are in Tier 1. During this period, for every RM1 of minimum average balance you have achieved, you earn 1 Star. So, if you retain a minimum average balance of RM500 in January, you will earn 500 Stars.

After reaching Month 5 (May), you progress to Tier 2. From May to August, for every RM1 minimum average balance, you earn 2 Stars. For example, your minimum average balance is RM1,000 in May, you would earn 2,000 Stars. - Can I redeem my loyalty stars for cash or withdraw them from my account?

Generally, loyalty stars cannot be directly redeemed for cash or withdrawn from your account. However, they can be used to access various rewards and benefits offered within the BoostUP Loyalty Program. - Is my BoostUP level the same as my BoostMyMoney tier?

No, BoostMyMoney tier is only used to calculate the monthly Boost Stars you earn from the Monthly Average Balance (MAB) you keep with BoostMyMoney. It will have no effect on any Boost Stars earning from the BoostUP loyalty program. - Can I track my loyalty program progress or view my earned rewards?

BoostMyMoney dashboard provides a progress bar to track your loyalty progress and view your earned rewards and current tier. You should be able to see your loyalty program tier status, accumulated (earned) stars, and progress to another milestone to reach the next tier. - If I fail to maintain a Monthly Average Balance (MAB) of RM500, will I be downgraded, or will my progress be reset?

If you fail to maintain a Monthly Average Balance (MAB) of RM500, your progress will reset, and you would start from Tier 1 again. Therefore, ensure to keep your MAB in BoostMyMoney of RM500 every month!

- How can I deposit to BoostMyMoney?

To deposit to BoostMyMoney, open your Boost app and click on the BoostMyMoney icon under ‘More’ page. Then, click on “Deposit” and follow the provided instructions to initiate a deposit request, which involves specifying the amount you wish to deposit from Boost Wallet to BoostMyMoney. Please be reminded that only Boost Wallet credits that is reloaded from a CASA account or online banking can be invested in BoostMyMoney. - How long does it take for the deposit amount to be processed and reflected in the available balance?

The processing time for any deposit transaction from Boost Wallet is generally reflected in the BoostMyMoney dashboard in “Total Value” in real-time. Please be reminded that any deposit performed will only be invested into BoostMyMoney / UOBAMM investment funds after the next working day, depending on the cut-off period. You can refer to the Boost Product Disclosure Sheet for more information. - What is the minimum and maximum deposit amount?

The minimum deposit amount will be RM1, and the maximum deposit amount will depend on your Boost Wallet balance. - Can BoostMyMoney accept credit card?

No, BoostMyMoney currently only accepts cash from the Boost Wallet balance that is deposited via a debit card or a personal (CASA) bank account. - How do I make a Cash Out request?

To make a Cash Out request, open your Boost app and click on the BoostMyMoney icon under ‘More’ page. Then, click on “Cash Out” and follow the provided instructions to initiate a Cash Out request, which involves specifying the amount you wish to withdraw and providing necessary details such as your bank account information. - How long does it take for the Cash Out amount to be processed and reflected in the bank account or Boost Wallet?

DestinationWithdrawal TypeProcessing TimeBoost Wallet Partial Withdrawal Instant Boost Wallet Full Withdrawal Next working day Bank account Partial Withdrawal Up to 4 working days Bank account Full Withdrawal Up to 4 working days - Why am I receiving a higher or lower amount than what I have entered in the withdrawal section?

The amount you entered is an approximate amount. This is subject to change based on the actual price at the point of fund redemption. - What is Partial Withdrawal?

Partial Withdrawal allows users to instantly withdraw up to 95% of their BoostMyMoney account balance to Boost Wallet or a bank account. For amounts exceeding 95%, it takes up to one working day to transfer to the user’s Boost Wallet or up to four working days to a bank account. - Why is my Cash Out to bank account taking so long?

There can be several reasons why a Cash Out transaction may take longer than expected. Some possible factors include banking processes, technical issues, or additional verification requirements due to wrong bank details. If your bank details are entered wrongly, you will be prompted back to the screen to re-enter your bank details. It is recommended to contact BoostMyMoney's customer support for assistance in determining the specific cause and status of your Cash Out transaction at support@myboost.com.my. - Where can I view my Cash Out transaction status?

You can view your status on the transaction history page.

- Are there any charges and fees when I invest into BoostMyMoney?

Yes, there are some fees associated with investing in BoostMyMoney:- Annual Management Fee - up to 0.5% per annum of the Net Asset Value (NAV) of the fund, calculated and accrued daily.

- Trustee Fee - Up to 0.04% per annum of the NAV of the Fund, subject to a minimum of RM6,000 per annum, calculated and accrued daily.

- If your account is dormant for more than one year without any transactions, a RM8 fee will be imposed to the account. Make at least one transaction within the year to keep the account active. This fee is currently waived until further notice.

- Are there any charges and fees when I make a deposit?

No, you will not be charged any fees when you deposit funds into BoostMyMoney.

- How do I close my BoostMyMoney account?

You can close the account via email by clicking the “Close My Account” on the “Accounts and Settings” page. - How can I file a complaint?

You can contact a Customer Support agent by clicking the “Customer Support” on the “Accounts and Settings” page.

- Is BoostMyMoney registered and safe in Malaysia?

Yes, Boost (Axiata Digital Ecode) is registered with the Securities Commission Malaysia (SC) as an Electronic Service Provider (eSP) operator to provide BoostMyMoney as an investment platform. BoostMyMoney allows Boost users to invest in the UOBAMM United Islamic Cash Management Fund, which is regulated by the SC. - Where is my money kept?

Your investment monies are held by a third-party trustee. The Trustee will act as trustee and custodian of the assets of the Fund and safeguard the interests of the Unit Holders. Pacific Trustees Berhad has been appointed as the trustee of the Fund.

- What is a cooling-off period?

Cooling-off period is the right given to investors to request for a refund of their investment if they are investing via BoostMyMoney for the first time. Investors may request for a cooling-off within six (6) business days from the first successful deposit. The cooling-off period will not apply once there is a withdrawal. - Who is eligible to the cooling-off period?

The cooling-off period is exclusively available to users who are making a subscription to the United Islamic Cash Management Fund for the first time. - How can I submit a cooling-off request?

- Contact our customer support at support@myboost.com.my

- In the respective communication please state

- Your full name

- Contact number

- Contact email

- Reason for initiating the cooling off process.

- Our customer service team will get back to you cooling off process.

- When will I receive my refund after submitting the request?

Once you have submitted your refund request, our team will process it promptly. Typically, refunds are issued within one week from the date of submission. However, please note that the exact processing time may vary depending on factors such as the payment method used and any additional verification requirements. - Is the cooling-off process for BoostMyMoney available to existing UOB Asset Management clients?

Yes, existing clients of UOB Asset Management are eligible to take advantage of the cooling-off process for BoostMyMoney. This process allows you to reconsider your investment within a specific timeframe after the initial purchase. Please refer to our official documentation or contact our customer support to learn more about the cooling-off period and the steps to initiate the process.